do i have to pay estimated taxes for 2020

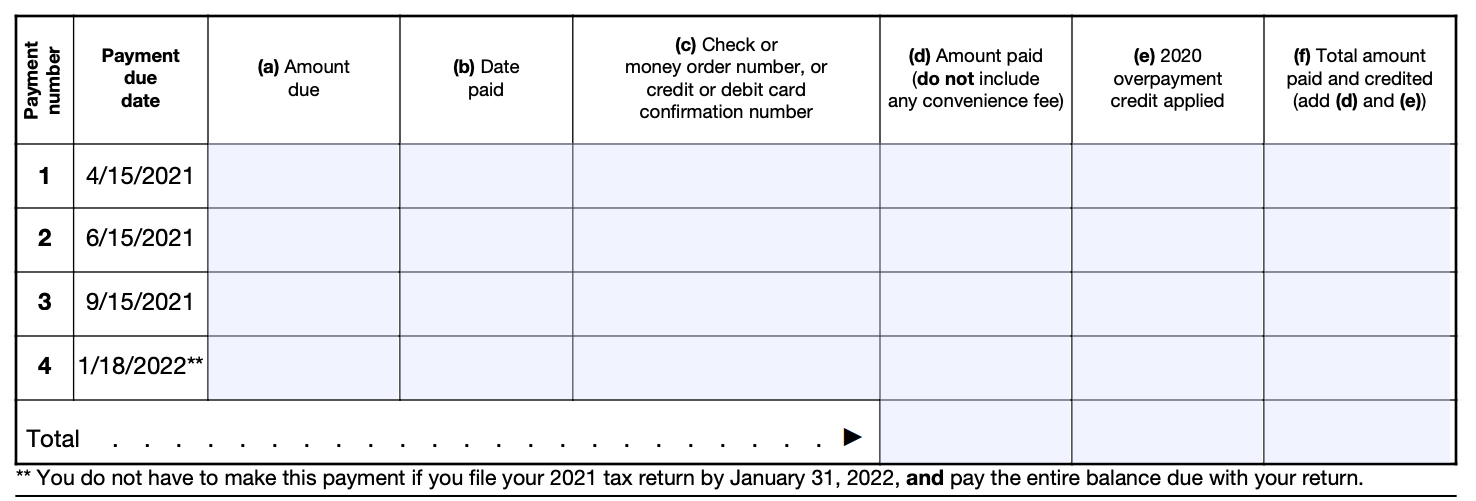

Basics of estimated taxes for individuals. And you dont have to make the payment due in mid-January when you file your tax return and pay what you owe before the end of the month.

Estimated Tax Payments Youtube

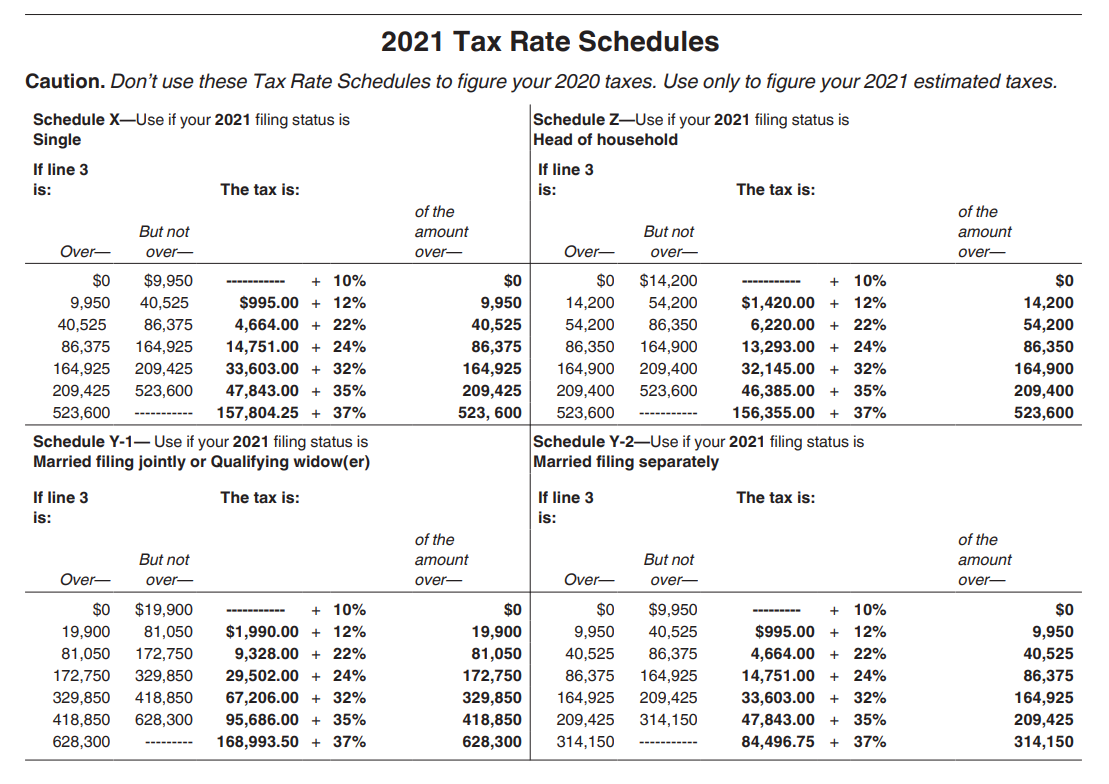

Due Dates Estimated tax payments are due in four equal installments on the following dates.

. An estimate will be considered timely filed if received on or before the due date or if the date shown by the US. IR-2020-205 September 9 2020. You should make estimated payments if your estimated Ohio tax liability total tax minus total credits less Ohio withholding is more than 500.

1st quarter payment due July 15th 2020. Generally you need to pay at least 80 of your annual income tax liability before you file your return for the year. This means that taxpayers need.

Tax system operates on a pay-as-you-go basis. Estimated payments are made quarterly. This means that you need to pay most of your tax during the year as you receive income rather than paying at the end of the year.

An estimate of your 2022 income. Estimated tax is the method used to pay tax on income that is not subject to withholding. Postal Service cancellation mark is on or before the due date.

2nd quarter July 15th 2020. If you file your income tax return by January 31 of the following year and pay your entire balance you do not have to make the January 15 payment. You may have to pay estimated tax for the current year if your tax was more than zero in the prior year.

Income Adjustment Review Unit. 250 if marriedRDP filing separately. How Partners Pay Estimated Tax.

You expect to owe at least 1000 in tax for 2020 after subtracting your withholding and. The amended due dates for estimated tax payments for 2020 are as follows. WASHINGTON The Internal Revenue Service today reminded the self-employed investors retirees and others with income not subject to.

Wisconsin Department of Revenue. And you expect your withholding and credits to be less. There are two ways.

2020 Extended Due Date of First Estimated Tax. April 15 first calendar quarter June 15 second. Taxes are pay-as-you-go.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. For additional information see FYI Income 51. The tool is designed for taxpayers who were US.

Ad Enter Your Tax Information. 中文 繁體 FS-2019-6 April 2019. See the worksheet in Form 1040-ES.

You must make estimated income tax payments if you. See What Credits and Deductions Apply to You. Electronic funds transfer Online Services - Its secure easy and convenient.

You can make a single payment or schedule all four payments at once. If you do not make the required estimated. Citizens or resident aliens for the entire tax year for which theyre inquiring.

This income includes earnings from self-employment interest dividends rents. In most cases you must pay estimated tax for 2020 if both of the following apply. You calculate that you need to pay 10000 in estimated taxes throughout the year and you dont make your first payment until June 15 when the second estimate is.

On the Landing page select. Form 1-ES 2022 Estimated Income Tax Payment Vouchers. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Because partners arent employees of the partnership partnerships dont withhold tax from their distributions to pay the partners income and self. Generally you must make estimated tax payments if in 2022 you expect to owe at least. Use Our Free Powerful Software to Estimate Your Taxes.

The estimated tax requirements are. Most people have withholding income tax taken out of their pay and are not familiar with the estimated payment requirement.

Estimated Tax Payments For Independent Contractors A Complete Guide

Safe Harbor For Underpaying Estimated Tax H R Block

Estimated Tax Payments Due Dates Block Advisors

Estimated Tax Payments For Independent Contractors A Complete Guide

What Happens If You Miss A Quarterly Estimated Tax Payment

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Forgot To Pay Quarterly Estimated Taxes Here S What To Do

What Happens If You Miss A Quarterly Estimated Tax Payment

Estimated Taxes Common Questions Turbotax Tax Tips Videos

Myths About Quarterly Taxes For The 1099 Tax Form Turbotax Tax Tips Videos

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

If You Have A Side Hustle Your Estimated Taxes Are Due Today Cnet

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Estimated Quarterly Tax Payments How They Work When To Pay In 2022 Nerdwallet

How Much Does A Small Business Pay In Taxes

Forgot To Pay Quarterly Estimated Taxes Here S What To Do

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

/TermDefinitions_Underpaymentpenalty_finalv1-4dfc8b09facc4bd3a480917c81ec5b7c.png)